2025 agenda

8:30: conference opening, MAIN STAGE

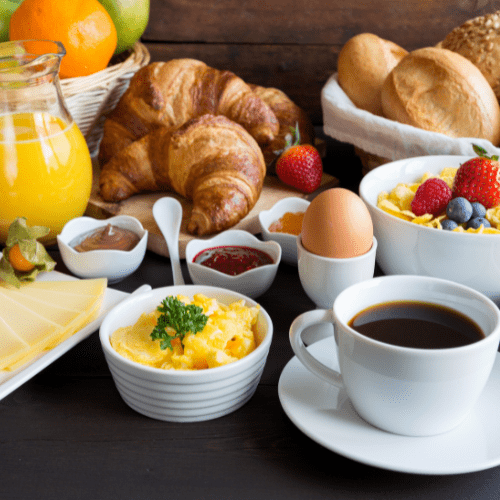

8:30: Registration, Breakfast & Opening Sessions (Halls A+B)

Start your day with fresh coffee, breakfast, and meaningful connections. Pick up your badge, meet fellow attendees, and ease into the day’s conversations before the main stage kicks off.

- Exhibition Area: open to all attendees for casual networking and a lively atmosphere.

- Meeting Lounge: an exclusive setting for speakers, sponsors, founders, investors and C-level executives.

09:20 - 9:30Opening Remarks🎤 Let's Get It Started: Welcome Remarks, Unfiltered

- Sophia Tupolev-Luz, Host & Producer, The Endgame – Israel’s Tech M&A Show

- Ben Pelled, Conference Founder, Lynx Events

No long intros. No fluff. Just a fast-paced, high-energy welcome. Our MC Sofia takes the stage alongside Ben, to kick things off with purpose and personality. Expect a sneak peek at what’s coming, a few surprises, and a clear message: this isn’t just a conference – it’s where things gets real.

09:30 - 09:40Keynote

09:30 - 09:40KeynoteTrust at Scale: How AI is Reinventing Identity in a Borderless World

By Pavel Goldman-Kalaydin, Head of AI/ML @ SumsubAs financial systems expand across borders and regulations grow more complex, the need for fast, accurate, and trustworthy identity verification has never been greater. In this opening keynote, Pavel Goldman-Kalaydin, Head of AI/ML at Sumsub, shares how cutting-edge AI is transforming digital onboarding, fraud prevention, and compliance – from KYC to deepfake detection.

Expect real-world insights, live trends, and a bold vision for building trust at scale in a frictionless, global fintech ecosystem.

09:40 - 09:50KeynoteBoost Your Finance Operations with Alteryx

- Avishay Levran, CTO @ ONE data.ai

- Raz Ben Chaim, Solutions Engineer @ ONE data.ai

In today’s fast-paced financial landscape, optimizing operations is paramount for companies handling immense transaction volumes and complex calculations.

This session demonstrates how to drive digital transformation in financial processes by: automating complex workflows, unifying disparate data sources, implementing sophisticated business logic, ensuring rapid adaptation to changing data.

We’ll highlight its support for accounting, month/year-end close, tax reporting, FP&A, internal audit, and SOX compliance.

09:50 - 10:00Keynote

09:50 - 10:00KeynoteThe Data Multiplier: Unlocking Value with Smart Architecture

By Keren Ben Zvi, Chief Data Officer @ PayUData is no longer just an asset – it’s an ecosystem. In this keynote, we’ll explore how tech leaders are rethinking their data foundations to scale smarter, move faster, and stay compliant across global markets.

In collaboration with Snowflake, this session dives into modern data architecture, real-time decisioning, and the shift from reactive reporting to proactive intelligence.

Whether you’re optimizing risk, personalizing customer journeys, or breaking silos, you’ll learn how to turn data into a multiplier – of speed, trust, and innovation.

10:00 - 10:10KeynoteAMD Advancing AI: The Future Runs on High-Performance Compute

- Yigal Shamaev, Senior Executive BD Manager @ AMD

- Ofir Ben Joseph, Solutions Architect @ AMD

As AI moves from experimentation to real-world deployment, the need for scalable, high-performance compute has never been greater. This keynote explores the infrastructure powering the GenAI revolution – and what it takes to build, deploy, and grow AI at scale.

AMD is a global leader in high-performance and adaptive computing, powering everything from cloud data centers to edge AI systems with cutting-edge CPUs, GPUs, and AI accelerators.

10:10 - 10:20Keynote

10:10 - 10:20KeynoteOne Platform, Every Customer Insight: Scaling Smarter with Unified Customer Intelligence

By Amir Segev, CEO & Co-Founder @ FireberryAs enterprises grow, so does complexity – with sales, marketing, and service teams often working in silos and relying on fragmented data. The result? Slower decisions, missed opportunities, and limited visibility.

This keynote reveals how unified customer intelligence – powered by a single platform and embedded AI – helps businesses operate smarter at scale. Discover how leading organizations are aligning teams, automating workflows, and transforming data into decisions that drive measurable growth.

10:20 - 10:35Fireside ChatThe Next Israeli AI Unicorn: What Will It Take - and Who Will Build It?

- Ziv Katzir, National Program Head, AI Infrastructure @ Israel Innovation Authority

- Adam Fisher, Partner @ Bessemer Venture Partners

Israel has long been known as the Startup Nation — but what will it take to build its next AI unicorn? In this exclusive fireside chat, Ziv Katzir, who leads the national AI infrastructure strategy at the Israel Innovation Authority, sits down with Adam Fisher, a seasoned investor and a partner at one of the world’s top 10 VCs to discuss the intersection of deep tech, investment, and scalable opportunity.

From research labs to global markets, this conversation will explore how to identify, support, and scale the next generation of AI companies from Israel to the world.

10:35 - 11:05Panel DiscussionFrom $1M to $1B: How Israel’s Top Unicorn Founders Scaled to the Big Leagues

Moderator: Ben Pelled, Founder & CEO @ Lynx by People & Computers

- Yoni Assia, Co-Founder & CEO @ eToro

- Yuval Tal, Founder & Former CEO @ Payoneer

- Ariel Assaraf, Co-Founder & CEO @ Coralogix

- Ori Goshen, Co-Founder, Co-CEO @ AI21 Labs

In this panel, we’ll go far beyond the polished soundbites. You’ll hear the real, unfiltered stories behind Israel’s top unicorns – the bold moves, painful setbacks, and defining moments that never made it into press releases.

This isn’t just a conversation; it’s a behind-the-scenes look at what it actually takes to scale from $1M to $1B. These founders aren’t here to impress — they’re here to tell the truth. Expect candor, a few laughs, and the kind of wisdom that only comes from doing it the hard way.

Recharge, connect with fellow attendees, and explore the exhibition area over great coffee

11:30 - tracks

Expand All +11:30: Founders & Investors (Hall B)

11:30 - 11:40Opening Remarks

11:30 - 11:40Opening RemarksWelcome to Founders & Investors Track

By Lirone Glikman, Global Biz Dev Expert | Speaker | CEO @ The Human FactorOver the past 20 months, Israeli startups have faced extraordinary challenges – war, economic turbulence, and global uncertainty. Yet through it all, the ecosystem has not only endured, but thrived – driven by unshakable resilience, bold innovation, and a relentless spirit.

Today, we gather to spotlight the defining themes shaping 2025 and to celebrate the founders, investors, and visionaries who are propelling this remarkable journey forward.

Track MC: Lirone Glikman, Global Biz Dev Expert, Speaker & CEO @ The Human Factor.

11:40 - 11:55Fireside ChatWhere Did All the Israeli FinTech Startups Go?

- Noam Inbar, Partner @ Viola Fintech

- Yonatan Mandelbaum, Partner @ TLV Partners

- Oded Zehavi, Co-Founder & CEO @ Mesh

The State of the Startup Scene in 2025 – and How to Spark the Next Wave of Innovation

Israel was once a fintech powerhouse—but in recent years, new startup activity has slowed dramatically. While sectors like cybersecurity boom, fintech appears to be in retreat.

In this session, top VC investors will explore what’s behind the decline, whether it’s a global or local trend, and what it will take to reignite fintech innovation in Israel. We’ll look at the data, the drivers, and the real opportunities that still lie ahead.

Using VibeCoding and No-Code tools, ideas become products in record time – without writing a single line of code. From AI-generated PRDs to working POCs, this is a real glimpse into how Gen-AI is transforming the way startups are built: faster, smarter, and leaner than ever.

Let’s AI is a dynamic platform focused on democratizing artificial intelligence knowledge. Offering a comprehensive blend of news, guides, courses, and insights, it caters to both AI enthusiasts and professionals.

With a mission to simplify AI education and promote industry innovations, it provides resources including podcasts, workshops, and AI tool insights, making AI accessible and actionable for businesses and individuals alike.

12:05 - 12:15Keynote

12:05 - 12:15KeynoteAI for All: Israel’s Unique Position in the Global AI Landscape

By Eilon Grouper, AI Entrepreneur & VisionaryExplore how Israel became a global AI leader and learn why the democratization of generative AI tools is opening new doors for everyone- tech savvy or not. Hear my personal journey of building Israel’s largest AI focused social media community and why this audience matters to you, today.

12:05 - 12:15Keynote

12:05 - 12:15KeynoteProtect to Scale: Why Your IP Strategy Can Make or Break Your Exit

By Allen Richter, Founding Partner @ Richter Shimoni Patent AttorneysIn today’s dynamic tech world, innovation is fast – but imitation is faster. For founders, a strong IP strategy isn’t just legal protection – it’s a business imperative.

Patent attorney Allen Richter shares essential IP strategies to help startup and scaleup founders protect their tech, avoid legal pitfalls, and strengthen their position for funding or acquisition.

From software patents to due diligence and global filings, learn how smart IP planning can become your unfair advantage. Whether you’re building with AI, blockchain, or next-gen finance tools, this talk will help you secure what truly sets you apart – your innovation.

12:25 - 12:50Panel DiscussionUnicorn or Cockroach? Navigating Growth vs Survival

Moderator: Michal Freeman-Shor, Head of Primary Markets (Israel), London Stock Exchange

- Adi Levanon, Founder & Managing Partner, Selah Ventures

- Maya Hawlasewicz, Principal, Pitango

- Omer Nagar, MP & CEO, The Garage

- Amitai Serphos, VP Growth, Lili

Startups in 2025 must balance two paths: the high-burn race to scale, and the lean journey to profitability. This panel addresses both — from Israeli companies that stayed lean to those that doubled down on growth despite wartime constraints.

Topics include remote team challenges during mobilization, fundraising delays, resilience planning, and how to build durable companies in uncertain markets.

Expand All +11:30: IT, Cloud & Security (Hall A)

11:30 - 11:40Opening Remarks

11:30 - 11:40Opening RemarksWelcome to IT, Cloud & Security Track

By Sharon Zarfati, Bridging Innovation Tech & Impact @ SZyncJoin us as we kick off the track with insights into the themes and what’s ahead, and welcome speakers, sponsors, and guests.

11:50 - 12:20Panel DiscussionBeyond Infrastructure: CIO Insights on AI, Innovation, and Institutional Agility

Moderator: Meital Raviv, Owner & CEO @ MERA

- Miri Gelbort, CIO @ Clal Insurance & Finance

- Iris Levanon, Deputy CEO | Head of IT Innovation Division @ Mataf / First International Bank of Israel

- Kobi Avnon @ Head of IT Infrastructure, DevOps & Cyber Unit @ Tel Aviv Stock Exchange

- Ishai Ram, Executive VP @ Sela

- Iris Keynan, CEO @ VisionBIT

CIOs at major financial institutions are navigating a new era – one defined not just by digital transformation, but by AI innovation, evolving customer expectations, and the need for rapid adaptability.

In this no-fluff panel, top tech executives share how they’re moving beyond infrastructure modernization to lead cultural and operational shifts within complex organizations. Expect real-world insights on adopting AI, driving innovation from the top, and building agile teams in a highly regulated, high-stakes environment.

12:20 - 12:30Keynote

12:20 - 12:30KeynoteTech Speakers TALK. The Smart Ones INFLUENCE. The Best Ones LEAD.

By Idit Neuderfer, CEO @ Redhead MethodWhy do some tech leaders win trust fast – while others lose the room?

In this TED-style talk, Idit Neuderfer, founder of The Redhead Method, reveals how sharp storytelling and strong delivery shift business outcomes | With real-world insights from banks, VCs, and global teams – you’ll get practical tips to speak with clarity, presence, and impact | From team meetings to investor calls, in Hebrew or English – know how to own the moment.

Talk. Influence. Lead.

12:30 - 12:50Panel DiscussionSecuring the Future: AI, Identity & Trust in a Digital-First World

Moderator: Idan Wiener, Co-Founder & CEO, illustria.io

- Pavel Goldman-Kalaydin, Head of AI/ML, Sumsub

- Meiran Galis, CEO & Founder @ Scytale AI

As AI reshapes industries, it also redefines the threat landscape. From deepfakes and synthetic identities to supply chain vulnerabilities and automated cyberattacks, organizations are facing a new generation of risks that challenge traditional security models.

In this high-level discussion, leaders at the forefront of AI, cybersecurity, and digital identity will explore how trust can be built – and protected – in an era of machine-generated threats. The panel will cover real-world use cases of AI in fraud detection and defense, the delicate balance between innovation and regulation, and strategies for securing infrastructure, code, and users at scale.

Join us for a forward-looking conversation on how companies can stay one step ahead in a world where identity is fluid, attackers are automated, and trust is the most valuable currency.

12:50 - tracks

Expand All +12:50: AI, Data & Vibe Coding (Hall B)

Join us as we kick off the track with insights into the themes and what’s ahead, and welcome speakers, sponsors, and guests.

Eden, our track MC, will also give a short keynote: Forget Tools. Train Your Brain.

In a world where tools change every week and your knowledge can become outdated within months – the real advantage belongs to those who think fast, move smart, and let go of what no longer works.

This talk dives into one simple and uncomfortable question: How do you stay relevant in a world where nothing stays still?

We’ll cover: How to spot approaches that last longer than the latest trend; The difference between knowing how to use AI – and knowing how to adapt with it; Why tools aren’t an advantage – but the thinking behind them is.

13:00 - 13:10KeynoteAI at Full Throttle: AMD’s Inference Power for Real-World Deployment

- Yigal Shamaev, Senior Executive BD Manager @ AMD

- Ofir Ben Joseph, Solutions Architect @ AMD

As AI moves from research to production, inference performance becomes the new battleground. In this technical keynote, AMD unveils how its next-gen CPUs, GPUs, and AI accelerators are purpose-built for high-throughput, low-latency AI inference across industries.

From financial fraud detection to personalized recommendations and autonomous operations — learn how AMD’s hardware and software stack empowers enterprises to deploy GenAI applications faster, smarter, and at scale.

Discover real-world benchmarks, use cases from finance and retail, and how to optimize your AI stack without compromise.

13:10 - 13:20Lightning Talk

13:10 - 13:20Lightning TalkOptimizing Equity Portfolios Using AI and Quantitative Models

By Tsuriel Horin, Chief Business Officer @ CherriesCHERRIES is a portfolio optimization platform designed to support institutional investors and advisors in constructing equity portfolios that balance return and risk. The system integrates AI methods with scientific and mathematical models to select and weight stocks based on user-defined constraints and objectives. Tsuriel Horin, Chief Business Officer, will present CHERRIES’ methodology, which focuses on maximizing yield while minimizing drawdown and volatility. Backtested and real-money portfolio results demonstrate consistent outperformance compared to leading benchmarks such as the S&P 500 in “Backtesting” simulation as well as in “real money” portfolios.

13:20 - 13:40Panel DiscussionThe AI-Powered Financial Institution: Personalization, Automation, and Decision-Making

Moderator: Yarden Lifshitz, Business Development Manager @ Zemingo

- Assi Dahan, VP Data Science & AI @ ONE data.ai

- Adi Yona, VP Product @ Cherries

- Kochavith Arnon, CEO @ KA

AI is reshaping every facet of financial services, from underwriting and risk analysis to hyper-personalized customer journeys. This panel showcases how leading players are operationalizing AI to enhance performance and outcompete rivals.

13:40 - 13:55Keynote

13:40 - 13:55KeynoteBeyond the Hype: Turning AI Code Generation into Enterprise-Ready Software

By Gilad Shoham, Dev & Open Source Leader @ Bit CloudAI code generators may shine in benchmarks but underdeliver in enterprise environments. They create outputs that compromise stability, increase maintenance costs, and reduce consistency. This talk introduces a new approach: enterprise-grade code generation that reuses existing assets, enforces standards, assesses impact, and delivers production-ready components.

14:00 - 14:20Panel DiscussionAI Agents in Action: Use Cases from the Front Lines

Moderator: Evyatar Edri, Co Founder @ Let’s AI

- Dedy Kredo, Co-Founder & CPO @ Qodo

- Alma Gadot Perez, Ecosystem Lead, Data and AI @ Israel National Digital Agency

- Tomer Zuker, Founder & Strategist Marketing Advisor @ Pave Your Way

- Ryan Penn, Managing Partner @ White Hawk Consultancy

- Tommy Barav, Co-Founder & CEO @ timeOS

From virtual teammates to autonomous decision-makers, AI agents are no longer theoretical – they’re reshaping how real work gets done. This panel brings together pioneers deploying agentic AI across industries to share concrete use cases, unexpected lessons, and what it really takes to put agents into production.

Join us for a front-line view of what’s working, what’s not, and what’s next.

Expand All +12:50: Retail, Payments & CFO (Hall A)

12:50 - 12:55Opening Remarks

12:50 - 12:55Opening RemarksWelcome to Retail, Payments & CFO Track

By Michal Hayon, Founder & CEO @ 2DO!Join us as we kick off the track with insights into the themes and what’s ahead, and welcome speakers, sponsors, and guests.

12:55 - 13:10Fireside ChatFrom Counter to Concierge: Reinventing Retail and Payments in the Luxury Experience

- Michal Hayon, Founder & CEO @ 2DO!

- Roy Carmel, CIO @ Golf & Co Group

Discover how Pandora, in partnership with Nayax, is merging elegance with efficiency, creating a seamless, high-touch shopping experience that removes friction from payment and elevates in-store service. Roy Carmel, CIO @ Golf & Co Group ,shares how advanced retail tech transforms every purchase into a premium, concierge-like moment.

13:10 - 13:20Keynote

13:10 - 13:20KeynoteScaling with Purpose: What it takes to Thrive in Global Fintech Today

By Adam Cohen, Chief Growth Officer @ PayoneerIn a world where fintechs can go global overnight, growth is no longer just about speed – it’s about intention. In this keynote, Adam Cohen, Chief Growth Officer at Payoneer, shares what it truly takes to scale with purpose in today’s complex, opportunity-rich financial landscape.

From navigating regulation to building resilient infrastructure and customer trust across borders, Adam will reveal hard-won lessons and future-forward strategies from one of the world’s leading global payment platforms. Whether you’re a startup eyeing expansion or a scaleup chasing sustainability, this session delivers the blueprint for going big without losing your edge.

13:20 - 13:40Panel DiscussionConnected Commerce: Powering Omnichannel Retail with Tech & Data

Moderator: Michal Hayon, Founder & CEO, 2DO!

- Idit Chen, CIO @ Lubinski Group

- Keren Ben Zvi, Chief Data Officer @ PayU

- Gil Tal, CTO @ Comax

As customer expectations rise, seamless experiences across digital and physical retail have become essential. This panel explores how technology and data are closing the gap between online and offline, creating frictionless, personalized journeys.

Join industry leaders as they share how AI, real-time data, and integrated platforms are transforming commerce — driving engagement, loyalty, and business growth.

13:40 - 13:50Keynote

13:40 - 13:50KeynoteBeyond Great Design and Technology: Why Digital Products Fail

By Hagit Liran, GM Strategy @ ZemingoIn this talk, we’ll explore why digital products often fail despite having outstanding design and cutting-edge technology. Drawing on real-world cases and extensive industry experience, we’ll uncover the critical importance of clearly defined business goals, strategic alignment, and meaningful measurement, to ensure digital products achieve genuine business impact and success

13:50 - 14:10Panel DiscussionFintech M&A in 2025

Moderator: Sophia Tupolev-Luz, Host & Producer, The Endgame – Israel’s Tech M&A Show

- Adam Cohen, Chief Growth Officer @ Payoneer

- Chaim Friedland, Partner, M&A Attorney @ Gornitzky

- Shelley Oppenheimer Levi, Partner @ EY

- Zeevi Michel, Partner @ Elaia

n 2025, Israeli M&A is seeing record activity — with deal volumes at a post-2022 high, Israeli-to-Israeli transactions going strong, and 2 fintech mega-exits resetting expectations. This conversation brings together the perspectives of a global acquirer, a leading VC investor, and two of Israel’s top M&A advisors to explore what’s driving the current wave of deals, how buyers are assessing risk and opportunity, and what founders need to know to position for successful outcomes. Together, we’ll look at how regulatory trends, valuation expectations and buyer behavior shaping today’s transactions — and where the next big fintech deals are likely to come from.

14:10 - 14:30Panel DiscussionUnlocking Hidden Value in the CFO Tech Stack; from Chargebacks to Strategic Gains

Moderator: David Feldman, Principal @ Flint Capital

- Shahar Tal, CTO @ Justt

- Alisa Applebaum, Sr. Director, Business Payments @ Guesty

- Erez Agmon, Co-Founder & CEO @ Vayu

Chargebacks are more than a payment nuisance – they’re a hidden drain on revenue and resources. In this panel, fintech leaders explore how AI-powered tools like Justt are helping finance teams fight fraud, win disputes, and recover revenue at scale.

We’ll also zoom out to look at the broader CFO tech stack, revealing untapped opportunities for efficiency, automation, and ROI. Whether you’re battling chargebacks or modernizing finance ops, this session offers actionable insights to drive smarter growth.

14:10 - tracks

Expand All +14:10: Web3, Blockchain & Crypto (Hall B)

14:10 - 14:20Opening Remarks

14:10 - 14:20Opening RemarksWelcome to Web3, Blockchain & Crypto Track

By Yoel Israel, Founder & CEO @ IsraelTech & WadiDigitalJoin us as we kick off the track with insights into the themes and what’s ahead, and welcome speakers, sponsors, and guests.

14:20 - 14:50Panel DiscussionFortifying the Future: Real-Time Security Infrastructure for Digital Assets

Moderator: Meirav Harel, Founder & CEO @ MHfintechs

- Dan Danay, Head of Web3 @ Check Point Software

- Mark Smargon, CEO @ Fuse.io

- Omer Sadika, Co-Founder @ Ika

- Bentzi Rabi, Co-Founder & CEO @ Utila

- Tomer Sharoni, CEO & Co founder @ Addressable

As crypto adoption grows, real-time security is no longer optional – it’s essential. This panel explores how on-chain firewalls and threat prevention are reshaping digital asset protection.

From contract exploits to bridge hacks and compliance risks, the threat landscape is evolving fast. How can institutions, protocols, and investors stay ahead? What does real-time defense really mean — and who’s responsible for implementing it?

Join us for a deep dive into the technologies and strategies defining the future of crypto security.

14:50 - 15:10Panel DiscussionFrom Fintech to Cryptotech: How Unicorns Are Integrating Digital Assets

Moderator: Adam Benayoun, Founding Partner @ Collider Ventures

- Noam Kaplan, Director, Head of Forensics & Blockchain Analytics @ KPMG Israel

- Sagi Winer, VP R&D @ Papaya Global

As crypto matures and regulation clarifies, fintech giants are no longer sitting on the sidelines. This panel will explore how leading fintech companies are building real-world integrations with crypto and blockchain infrastructure.

What are the business drivers, compliance challenges, and customer use cases? Meet the leaders who are shaping the convergence of traditional finance and the decentralized economy.

15:10 - 15:30Panel DiscussionCrypto Beyond the Hype: Building Sustainable Ecosystems in Web3

Moderator: Shauli Rejwan, Managing Partner @ Masterkey

- Jeremy Musighi, Entrepreneur in Residence @ Fhenix

- Shelly Hod Moyal, Founding Partner & Co-CEO @ iAngels

- Ben Samocha, CEO & Co-founder @ CryptoJungle

As the dust settles from crypto’s boom-and-bust cycles, industry leaders are shifting focus from speculation to sustainability. This panel brings together key investors, innovators, and policy shapers to explore the long-term building blocks of Web3.

We’ll discuss regulatory developments, infrastructure readiness, real-world asset tokenization, and the changing expectations of users and VCs. How do we transition from hype to habit? And what role will Israel play in the global crypto landscape?

© Copyright Lynx by People & Computers 2025 Click for Accessibility

Click for Accessibility